October 2021

Introduction

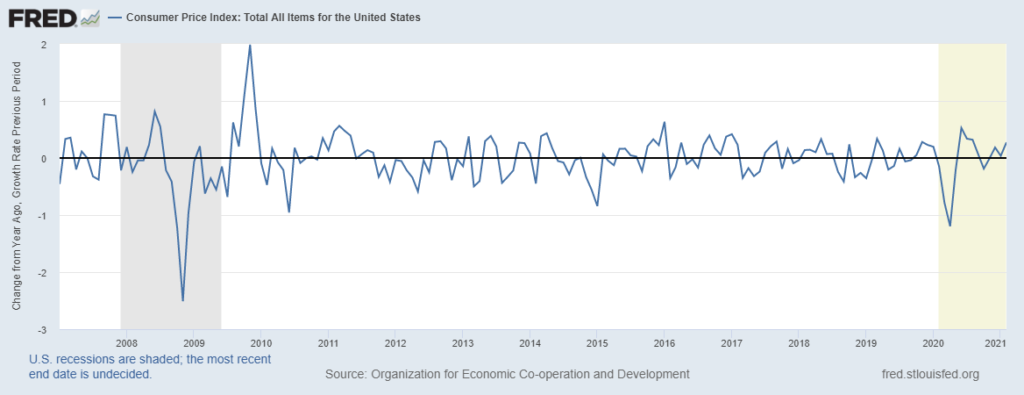

US Consumer Price Index

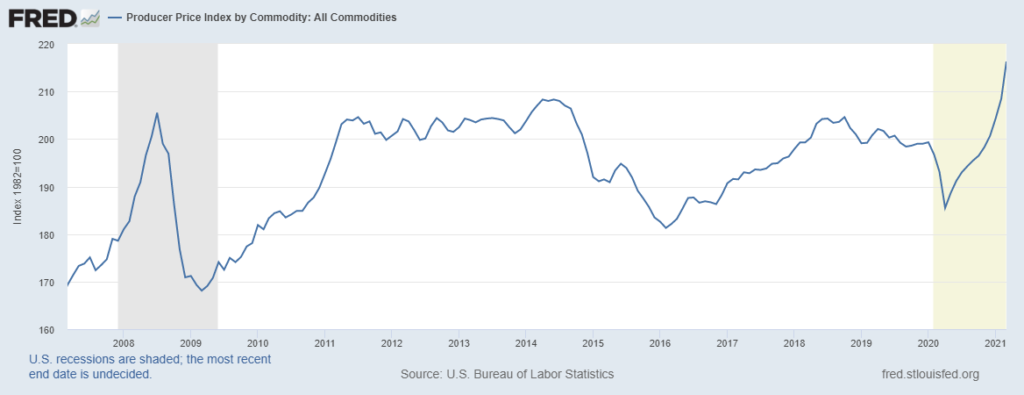

In Conclusion

DISCLAIMER: WealthLander Pty Ltd ACN 646 957 119 is a corporate authorised representative (CAR; WealthLander) of Boutique Capital Pty Ltd (BCPL) ACN 621 697 621 AFSL 508011, CAR Number 1285158. CAR is the investment manager of the WealthLander Diversified Alternative Fund (Fund).

To the extent to which this document contains advice it is general advice only and has been prepared by the CAR for individuals identified as wholesale investors for the purposes of providing a financial product or financial service under Section 761G or Section 761GA of the Corporations Act 2001 (Cth).

The information herein is presented in summary form and is therefore subject to qualification and further explanation. The information in this document is not intended to be relied upon as advice to investors or potential investors. It has been prepared without considering personal investment objectives, financial circumstances or particular needs. Recipients of this document are advised to consult their own professional advisers about legal, tax, financial or other matters relevant to the suitability of this information.

The investment summarised in this document is subject to known and unknown risks, some of which are beyond the control of CAR and its directors, employees, advisers or agents. CAR does not guarantee any particular rate of return or the performance of the Fund, nor do CAR and its directors personally guarantee the repayment of capital or any particular tax treatment. Past performance is not indicative of future performance.

The materials herein represent a general summary of CAR’s current portfolio construction approach. Depending on market conditions and trends, CAR may pursue other objectives or strategies considered appropriate and in the best interest of portfolio performance.

There are risks involved in investing in the CAR’s strategy. All investments carry some level of risk, and there is typically a direct relationship between risk and return. We describe what steps we take to mitigate risk (where possible) in the Fund’s Information Memorandum, which must be read prior to investing. It is important to note that despite taking such steps, the CAR cannot mitigate risk completely.

This document was prepared as a private communication to clients and is not intended for public circulation or publication or for the use of any third party without the approval of CAR. While this report is based on information from sources that CAR considers reliable, its accuracy and completeness cannot be guaranteed. Data is not necessarily audited or independently verified. Any opinions reflect CAR’s judgment at this date and are subject to change. CAR has no obligation to provide revised assessments in the event of changed circumstances. To the extent permitted by law, BCPL, CAR and its directors and employees do not accept any liability for the results of any actions taken or not taken on the basis of information in this report or for any negligent misstatements, errors or omissions.

This Document is for informational purposes only and is not a solicitation for units in the Fund. Application for units in the Fund can only be made via the Fund’s Information Memorandum and Application Form.